Estate And Tax Assessment & Evaluation

Walk Away With A Crystal Clear Understanding Of The Gaps, Holes, Leaks, and Traps That You Might Be Exposed To, And How To Fix Them Before They Turn Into Probate Nightmares That Haunt Your Family For Years...

My Family Has Been Through It. Believe Me - It's Not Fun!

Press Play To Watch This Short Video

The Approach: Reverse Engineering Your Legal & Tax Systems From The Bottom-Up

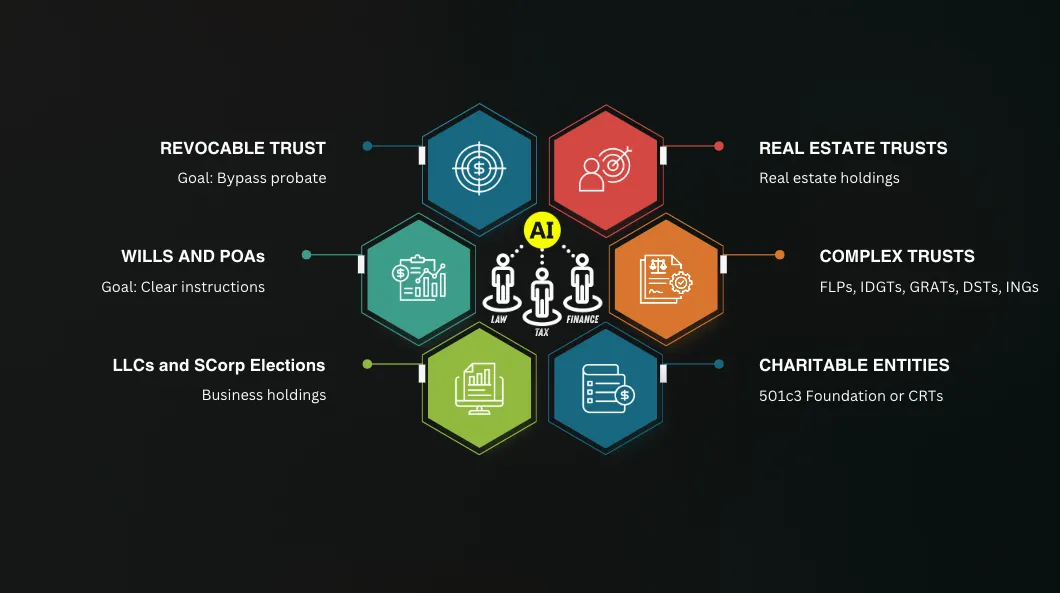

If pictures represented a 10,000 words, here's what the "mini family office approach" looks like:

HERE ARE THE "WORDS".

What the Law & Tax Assessment & Evaluation Session Covers:

1. Entity Structuring [Person = individuals, corporations, associations, estates, trusts, and nonprofits]

Overall strategy: Do your LLCs, Corps, and Trusts align with your earning + investment + transfer strategy?

Compliance: Are you mixing ownership and control in ways that trigger tax or probate?

Alignment: Are your entities aligned, coordinated, and in-sync with each other or misaligned, disjointed, and mismatched?

2. Estate & Tax Exposure

Asset inventory: What’s in your estate vs. what has been removed from it (from a compliance standpoint)?

Compliance: Have you filed proper gifting forms (e.g., Form 709)? Is there a trustee in place?

Potential disputed: Are your assets at risk of double probate, valuation disputes, or IRS clawbacks?

3. Assets: Insurance, Crypto, Real Estate & IP

Asset holding: Are these structured properly to avoid estate inclusion?

Probate rules: Are these assets subject to probate right now? If so, what sort of legal costs and taxes can your family expect?

Basis allocation: What is the "base" when assets are transferred to heirs? Comparing entities and cost basis allocation.

Transfer mechanism: Are you using the right transfer mechanism for each asset class?

Each asset class is dictated by different rules - some are federal tax rules, and some are governed by the state business, estate, or probate rules.

4. Foundation & Philanthropy Potential

Tax Conversion & Reinvesting: Could your taxes fund a philanthropic and legacy project? If so, how?

Strategic Giving: Are you using strategic giving to reduce income or estate taxes - are you documenting the gifts & donations?

The Wild-Card: Have you aligned the estate plans, business plans, exit strategies, or tax reduction strategies with the foundation?

5. Alignment of Experts On Your Team

Alignment: Are your lawyer, CPA, financial advisor, realtor, and insurance agent aligned and operating from the same playbook?

Communication: Are your law, tax, and financial advisors communicating with each other, OR are they operating in silos?

Flow Like Water: Do your entities flow like water, taking the path of least resistance, or are they fighting an uphill estate & tax battle?

Your Assessment and Outcomes:

A full snapshot of your legal-tax-financial architecture, identifying:

Legal, tax, and financial gaps, traps, holes, and leaks

Estate protection and tax reduction opportunities

Entity and tax restructuring suggestions:

Part of estate - evaluating what assets can be transferred through the estate without complicated probate proceedings

Removed - evaluating what assets can be removed from the estate via gifting to an individual or trust (independent trustee)

Foundation - evaluating what assets can be strategic donated to a foundation (family is on the board)

Flow Like Water - the "Mini Family Office" approach where business, estate, nonprofit, and tax strategies flow around problems, obstacles, and hurdles by leveraging a "multi-entity" approach that is flexible and adaptable to the situation

Ideal for:

Entrepreneurs and business owners

Real Estate, Stock, and Crypto Investors

Professionals with assets: $2m - $40m

Anyone tired of siloed advice and cookie-cutter planning

Individuals who want to learn the law and avoid legal or tax scams, Ponzi schemes, and legal or tax impostors

If you prefer a brief 15-20 minute chat with us to explore whether this is a good first step, please visit the Contact Us page and schedule a 1:1 Confidential and 100% Pro-Bono Consultation with us.

Proceed Below:

Law And Tax Assessment & Evaluation

step 1:

Fill out the estate and tax assessment form

STEP 2:

sign the law and tax evaluation & assessment disclaimer agreement

STEP 3:

complete your purchase

100% Money-Back Guarantee (Included in the terms - clause 8)

STEP 4:

SCHEDULE YOUR FIRST LAW AND TAX ASSESSMENT SESSION [50-60 MINUTE CALL]

Please Note:

Do Not Book this session if you have not completed steps 1-3 above - we will cancel your meeting.

If you prefer to have a 15-20 minute consultation before moving forward on this page, please visit the contact us page to schedule a call.

© Copyrighted Material. All Rights Reserved. Become A Philanthropist LLC.

No Legal, Tax, Financial, or Investment Advice Contained - 100% Educational And Entertainment Purposes Only. No Attorney-Client or Fiduciary Relationship Is Formed By Contacting, Communicating, or Engaging With Us In Any Matter, Unless A Signed Agree Exists With The Terms and Conditions Of The Engagement.