Multi-Generational Wealth Preservation Experts

Mini Family Office™ helps professionals and families harness AI to align business, estate, nonprofit, investment, and tax strategies - with a focus on uncovering and fixing hidden leaks, gaps, and compliance traps that can silently erode 10–40% of your wealth.

We created the Mini Family Office™ Method after experiencing the nightmares caused by entity piercings, bankruptcy lawsuits, asset seizures, financial scams, and probate disasters. Our mission is simple: to prevent those same legal and financial disasters from happening to you and your family.

Mini Family Office Fuses Two Decades Of Business, Estate, Nonprofit, and Tax Architecture, Planning, and Implementation

$5+ Billion

In wealth restructured

25,000+

Legal and entity filings

50,000+

Hours of law and tax research

10,000+

Over 10,000 cases under our belt

Wealth Protection.

Tax Reduction.

IP Monetization.

Welcome To The Mini Family Office™:

It's TEDx Speaker, Philosopher, Tax Attorney, and Serial Entrepreneur in the legal tech space, Sid Peddinti here - Nice to meet you.

After representing tens of thousands of people in diverse industries over the past two decades, here's what we have found:

Most entrepreneurs, investors, and families build their team of advisors slowly over time, and in a highy piecemealed manner - a lawyer here, an accountant there, a financial advisor, an insurance agent, or investment guru when profits accumulate later on.

But here’s the problem:

👉 These professionals rarely speak to each other.

👉 They operate in silos and are "in their own world".

👉 But probate, estate, and tax laws look at the big picture - everything together.

👉 And that's when misaligned entities, conflicting terms, compliance errors, and large tax bills pop-up.

👉 The result: A probate and tax nightmare that drags on for years.

Let's dig a little deeper:

The business lawyer files corporate papers.

The IP lawyer registers trademarks.

The CPA files annual taxes.

The financial advisor manages your investments.

The insurance agent sells policies.

The realtor sells property.

The investment coach talks stocks, crypto, real estate, or forex.

But none of them have connected the dots for you.

No one is focused on the "BIG PICTURE".

Except for the other side - the banks, the courts, and the tax department.

The result?

Mismatched strategies, missed filings, entities out of compliance - and catastrophic wealth leaks that only show up after death.

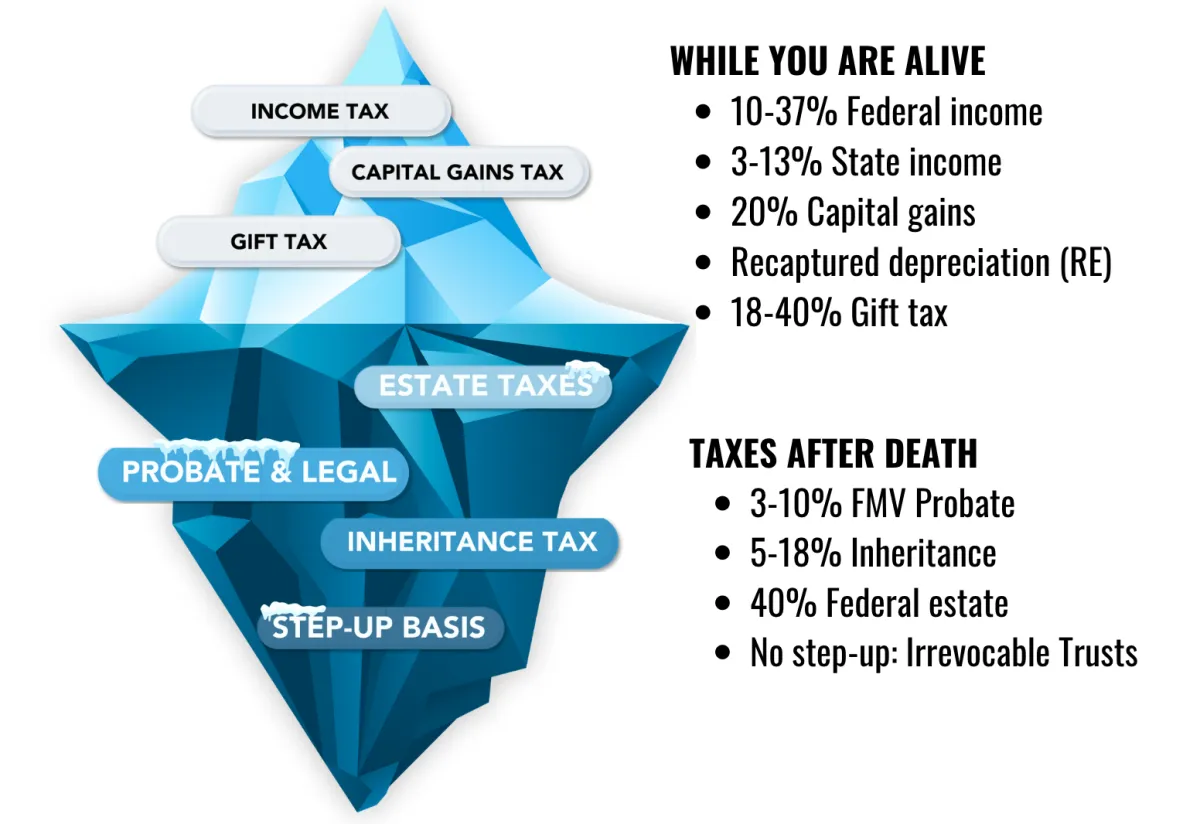

The Real Cost of Gaps and Traps

Without an integrated strategy, families face:

Probate costs, executor fees, and legal expenses (3–7% of estate value).

State inheritance taxes and federal estate taxes (10–40% of wealth lost).

IRS valuation challenges and succession battles.

Lost crypto wallets and improperly transferred business assets.

2–3 years of probate delays that drain money, energy, patience, and relationships.

Here is a picture that shows you the various layers of taxes that are imposed while you are alive...

And those that kick in after your death - which you are NOT here to fix, pay, or defend.

I’ve lived these nightmares firsthand:

2005: Banks pulled the plug on my bakery, pierced my entities, and wiped me out overnight.

2009: My grandfather passed, triggering a probate nightmare that lasted years and consumed 60% of his estate.

And over the past two decades, since I entered the world of "law and tax" after my million-dollar bankruptcy experience at the age of 22 in 2005, I’ve seen thousands of families - good people with good intentions - fall into the same traps.

The "hidden" layers of taxes (beneath the surface) are like a hot potato, being passed around by one expert to another - and the one that it will eventually, and always, get out - is you and your family.

Why This Happens

Most “estate planning” is piecemeal.

Most “tax strategy” is reactive.

Most “legal documents” are drafted in isolation.

Most "investments" are made without calculating future tax obligations (death tax).

Ignorance of the law is not bliss.

One small oversight can send your assets to probate - and it’s too late to fix it once you’re gone.

BILLION DOLLAR LAW & TAX MISTAKES™

You may be reading this and don't think these situations apply to you.

Maybe you are right, maybe not.

I've assembled 100+ real business, estate, insurance, real estate, crypto, stock, and trust cases with mistakes that have collectively cost families BILLIONS of dollars.

They cover all sorts of asset categories, legal structures, business IP, and even famous cases where even celebrities with the most sophisticated teams have committed these mistakes!

THE SOLUTION: The Mini Family Office™

... modeled after family office services offered at banks and investment management firms.

... where we look at the BIG PICTURE - the same approach used by the Government and Courts.

... and, we've built a ton of AI tools to help you uncover these blind spots that your advisors may have missed.

What We Do

We serve as your strategic partner in business, nonprofit, and multi-generational wealth preservation.

... think of us as a second set of eyes, armed with the Tax Code and the most sophisticated Tax Detective,

... Mythbuster AI™, trained with tens of thousands of cases, codes, strategies, tax records, and real portfolios of entrepreneurs and investors across the country.

Our Unique Integrative Estate & Tax Services™ align all the moving parts of your financial life into one cohesive architecture:

Business succession and exit planning

Advanced estate and entity planning

Intellectual property creation and protection

Tax law and research and reporting

Trust architecture and compliance

Insurance structuring and compliance

Entity design and compliance

Gifting and philanthropic investing with nonprofits and foundations

Crypto and stock transfer strategies

Real estate holding and liquidation strategies

Evaluation of complex structures (GRATs, CRATs, IDGTs, DSTs, FLPs, etc.)

Reinvesting "otherwise tax dollars" into charitable investments and donations

Incorporation of tax-exempt, grant-funded public educational nonprofits with your business

Compliance WatchDog: Helping you avoid law, tax, finance, and marketing scams, Ponzi schemes, impostors, and fraudsters with our AI-Powered Compliance Scanners: Mythbuster AI™

This is the operating system of the world's most successful families.

Instead of fragmented advice, you get one unified playbook.

Why It Matters

💡 Death and taxes are not optional.

💡 Probate is the default.

💡 The government is a silent beneficiary - entitled to 10–40% of your estate if you don’t "intentionally" disinherit them.

But here’s the good news:

Probate costs, death taxes, and silent beneficiaries are optional.

The tax code provides pathways to bypass them - but only with careful, structured, and proactive planning.

That’s exactly what we deliver.

Your Next Step

At Mini Family Office™, we:

Identify hidden leaks, gaps, and traps in your current structure.

Design the legal and tax architecture to patch them.

Preserve and protect your wealth across generations.

It usually takes just one in-depth call to uncover 6–8 figures in hidden death tax bills waiting beneath the surface.

Let’s identify and fix these gaps before they consume half your wealth after your death.

Explore our resources, videos, podcasts, and case studies.

We’ve worked on, researched, and dissected tens of thousands of cases and situations to perfect this approach.

📞 Ready to protect your wealth and legacy?

Schedule a call today.

Sincerely,

Sidhartha, Esq.

BA, BIA, LLB/JD, LLM

Solutions & Strategies In A Nutshell

Start A Nonprofit Center (Education-Focused)

Registration and approvals

Website & content generation

Branding and positioning

Grant acquisition from corporations

Monetization of IP & knowledge

Law, tax, and finance compliance

Alignment with business ventures

Start A Private Foundation (Investment-Focused)

Registration and approvals

Website & program creation

Align with estate planning strategy

Align with tax reduction strategy

Align with asset protection strategy

Investment consulting & compliance

Law, tax, and donation compliance

Mini Family Office Consulting (Big Picture)

Holistic "business, estate, nonprofit, and tax" strategy under one roof

Alignment of lawyers, accountants, financial advisors, insurance agents, and real estate teams & strategies

Maximization of wealth by minimizing 10 distinct layers of taxes & costs

Scale Your Business Or Nonprofit With AI

Harness the infinite power of AI

New IP creation and monetization

How to clone your brain with AI

Content creation and automation

Building AI Agents to perform tasks

Deploying a digital clone for videos

Maximize Profit and Impact

Don't make the business, estate, and tax mistakes that can destroy 10-50% of your wealth

Get a complimentary evaluation to explore the hidden legal and tax traps and blind spots in your estate & tax plans before it's too late...

You are NOT going to be here to pay the tax and court bills, explain your situation or intentions, and will be leaving it to your loved ones to deal with the mess.

We can help you gain clarity on how to navigate these complex, shark-invested, legal and tax waters with confidence.

BILLION DOLLAR LAW & TAX MISTAKES

The fastest way to learn tax law and tax strategy?

Read actual cases: learn from mistakes without making them

Our mission is to save you a TON of time, energy, and research so you can avoid million-dollar mistakes:

All it takes is a few extra words in a will or trust...

Or a lack of essential words, in some cases...

Or an asset that is still held in your personal name at death...

Or a slight valuation dispute...

Or one of the 100+ mistakes compiled in the section - BILLION DOLLAR MISTAKES...

To actually send your case to probate court or tax court.

Your loved ones are going to be stuck "piecing everything together"...

And there's a good chance they're not involved in everything you're doing, investing in, structuring, or creating during your life...

So good luck putting it together AFTER your death.

Visit the BILLION DOLLAR MISTAKES page in the Knowledge Hub Section to view these cases in more depth.

Many cases reveal the "million-dollar time bombs" that you are sitting at right now - and how you can fix it.

Let's cover the TOP 8 mistakes that we encounter on a day-to-day basis...

You can visit the Billion Dollar Mistakes after that.

Legal Myth and Mistake 1: Thinking That Wills Avoid Probate

Legal Issue: Does having a will avoid probate?

Rule: Uniform Probate Code §2-101 - A will passes through probate unless replaced by non-probate mechanisms like trusts or TODs.

In other words, probate is the "default".

The silent beneficiary (The IRS and Court) is expecting a piece of the pie UNLESS you intentionally disinherit them by forming the right estate transfer documents.

Analysis:

✅ In In re Estate of Fick, 678 S.E.2d 46 (N.C. Ct. App. 2009), the court confirmed that a will triggered full probate proceedings.

✅ In Estate of Westfall, 812 S.W.2d 903 (Mo. 1991), relying on a will caused disputes among heirs and probate litigation.

✅ In Estate of Jackson, 2020 WL 1467049 (Cal. Super. Ct. 2020), high-profile estates relying on wills resulted in prolonged court battles.

✅ In Estate of Thompson, 2013 WL 5407383 (N.Y. App. Div. 2013), the court highlighted how wills failed to transfer certain assets smoothly.

Flow Like Water Tip:

Use a layered plan with revocable trusts, TODs, and properly titled assets.

A will alone directs the court - it does not bypass it.

Avoid probate by structuring assets to transfer outside of the court system.

Legal Myth and Mistake 2: Gifting Without Giving Up Control

⚰️ Estate Tax Inclusion After Gifting

Legal Issue: If I give away assets before I die, are they still part of my taxable estate?

Rule: IRC §§2036–2042: If you retain control or benefit, the IRS includes the asset in your estate.

Analysis:

✅ In Estate of Strangi, 417 F.3d 468 (5th Cir. 2005), the IRS pulled $11 million into the estate due to retained control over a family partnership.

✅ In Estate of Powell, 148 T.C. 18 (2017), the court ruled that even indirect control over voting power triggered inclusion.

✅ In Estate of Bigelow, T.C. Memo. 2005-65, poor execution led to full estate inclusion.

✅ In Estate of Bongard, 124 T.C. 95 (2005), failure to prove a legitimate business purpose made transfers look like tax shelters.

Flow Like Water Tip:

Giving away the asset on a piece of paper is not enough - give up the title too, especially real estate or other assets.

Giving up the title also isn’t enough - give up control as well.

Use properly drafted irrevocable trusts and remove all retained powers.

Ensure you file the right tax forms and time the transfer - otherwise the IRS will not consider it as a completed gift.

And if it is NOT completed - that means its still in your estate and subject to multiple layers of death taxes.

Finally - Be careful with FLPs, GRATs, CRATs, IDGTs, and even LLCs - execution matters more than the document.

The IRS and Courts look at "substance over form" - what is happening in reality versus what the paper says - in short, don't try to "fool" them on paper by claiming it is a gift, when you are still controlling and enjoying the "gifted asset".

Legal Myth and Mistake 3: Gifting Without Filing Form 709

🧾 Gift Tax & Form 709 Confusion

Legal Issue: Do I need to file anything if my gift is under the annual exclusion limit?

Rule: IRC §2503(b), §2511: Certain gifts require Form 709 even under the limit, especially if incomplete or trust-based.

Analysis:

✅ In Commissioner v. Estate of Sanford, 308 U.S. 39 (1939), a trust gift was ruled incomplete and included in the estate.

✅ In Estate of Petter, T.C. Memo. 2009-280, formula clauses were scrutinized, and reporting protected the taxpayer.

✅ In Estate of Cristofani, 97 T.C. 74 (1991), improper trust structuring led to questions on exclusion eligibility.

✅ In Estate of Dieringer, 146 T.C. 117 (2016), lack of proper reporting caused valuation issues and tax adjustments.

Flow Like Water Tip:

Always file Form 709 for trust gifts, even if under the annual $19,000 limit.

Confirm gifts are “complete” legally - not just emotionally.

Use independent trustees to support your decisions, ensuring you are no longer in control.

Use Crummey notices and proper language to make trust gifts IRS-proof (especially for insurance policies).

Legal Myth and Mistake 4: Trusts Give Me Asset Protection and Privacy

🛡️ Trusts & Asset Protection

Legal Issue: Do all trusts protect you from lawsuits and creditors?

Rule: Revocable trusts offer zero protection; irrevocable trusts fail if you retain control, same with offshore.

Analysis:

✅ In FTC v. Affordable Media, 179 F.3d 1228 (9th Cir. 1999), an offshore Cook Islands trust was pierced due to retained control.

✅ In United States v. Grant, 2013 WL 1729380 (S.D. Fla. 2013), the IRS penetrated an offshore trust.

✅ In In re Lawrence, 279 F.3d 1294 (11th Cir. 2002), a domestic judgment defeated a supposed asset protection structure.

✅ In U.S. v. Roye, 2023 WL 5600067 (C.D. Cal. 2023), a self-settled trust was deemed fraudulent and dismantled.

Flow Like Water Tip:

Irrevocable = offers strong protection, but takes away control.

Revocable = offer no protection, but gives you full control.

Don’t keep control, power, or benefit if "asset protection" is the goal.

Offshore doesn’t mean invisible = substance beats form (paper structure).

Legal Myth and Mistake 5: My Spouse Inherits Everything - I Don't Need An Estate Plan

Legal Issue: Will my spouse get everything if I die without a plan?

Rule: Uniform Probate Code §2-102: Spousal rights vary based on other heirs and state law.

Analysis:

✅ In Estate of Mellinger, T.C. Memo 1999-300, lack of planning created disputes between the spouse and children.

✅ In Estate of Lee, 2009 WL 2448563 (Cal. App. Ct.), intestacy laws split assets among estranged family members.

✅ In Estate of Harrell, 2011 WL 1832762 (Tex. App.), title-based ownership conflicted with assumed spousal rights.

✅ In Estate of Cushing, 2020 WL 2486271 (Mass. Prob. Ct.), default rules led to forced property sales to distribute value.

Flow Like Water Tip:

Don't leave your spouse to the mercy of state law.

Use trusts, beneficiary designations, and joint titling to ensure clarity.

Your assets may still go through probate before your spouse gets them.

Avoid probate surprises by planning the full map - not just hoping for fairness.

Legal Myth and Mistake 6: My Business Passes To My Heirs Automatically

🏢 Business Succession – Family Automatically Gets the Business?

Legal Issue: Does your business automatically pass to your family after death?

Rule: IRC §§2031 & 6166: Business interests are included in the estate and may be subject to estate taxes, valuation disputes, and probate delays.

Analysis:

✅ In Connelly v. United States, 70 F.4th 412 (8th Cir. 2023), the IRS included $3.5M in life insurance proceeds in the valuation of a closely held business, triggering $890,000+ in estate tax.

✅ In Estate of Blount v. Commissioner, T.C. Memo 2004-116, the IRS challenged valuation discounts, increasing estate tax liability.

✅ In Estate of Giustina v. Commissioner, 586 Fed. Appx. 417 (9th Cir. 2014), improper valuation of partnership interests led to higher estate taxes.

✅ In Estate of Gallagher v. Commissioner, T.C. Memo. 2011-148, inconsistent planning and valuation disputes cost the estate millions.

Flow Like Water Tip:

Don’t assume ownership = automatic transfer.

Build a buy-sell agreement with fixed terms, clear funding (life insurance), and defined valuations.

Use entity planning and succession documents to avoid IRS interpretation.

Legal Myth and Mistake 7: My Life Insurance Policy Does Not Face Taxes And Is Protected From Lawsuits

🧾 Life Insurance & ILITs - Tax-Free and Out of Estate?

Legal Issue:

Is life insurance excluded from the estate if owned by a trust?

Is life insurance tax-free?

Rule: IRC §2042: Life insurance is included in the estate if the decedent retains any "incident of ownership" (e.g. power to change beneficiary, change terms, borrow loans, or pay premiums).

Analysis:

✅ In Estate of Gerson v. Commissioner, T.C. Memo 1987-567, the IRS included the entire policy benefit in the estate due to retained control.

✅ In Estate of Skifter v. Commissioner, 468 F.2d 699 (2d Cir. 1972), failure to relinquish powers caused inclusion.

✅ In Estate of Ledford v. Commissioner, T.C. Memo 1983-431, the grantor’s continued premium payments invalidated the ILIT.

✅ In Estate of Robinson v. Commissioner, T.C. Memo 2010-100, DIY execution led to full estate inclusion despite the use of a trust.

Flow Like Water Tip:

Fund ILITs with gifted premiums - not personal checks.

Avoid retained powers (no control, no amendment rights).

File Form 709 annually for premium gifts and ensure proper trustee administration

Legal Myth and Mistake 8: My Cryptocurrency Is Private, Not Taxed, and Protected Due To The Blockchain

🪙 Cryptocurrency - Private, Untaxed, and Invisible?

Legal Issue: Is cryptocurrency untaxed and anonymous by default?

Rule: IRS Notice 2014-21 + IRC §6038D: Crypto is treated as property; gains are taxable and must be disclosed, including foreign holdings.

Analysis:

✅ In United States v. Coinbase, Inc., No. 17-cv-01431-JSC, 2017 WL 5890052 (N.D. Cal. Nov. 28, 2017), the court compelled Coinbase to hand over data on 14,355 users.

✅ In U.S. v. Gratkowski, 964 F.3d 307 (5th Cir. 2020), the court ruled that crypto transaction data is not protected by privacy rights.

✅ In IRS v. Kraken (2023 settlement), the IRS obtained thousands of customer identities and transaction records.

✅ In U.S. v. Doe, IRS audits identified unreported gains of $400,000+, showing that hidden wallets can still be traced through blockchain analytics.

Flow Like Water Tip:

Crypto = property. Report it, track basis, and document transfers.

Include crypto in your estate plan - consider gifting and donation strategies.

Lost keys = lost assets and taxable event (even without access).

Use smart contracts, custodial keys, and cold wallets with legal alignment.

Change the title of your crypto accounts to match the trusts or foundation.

Billion Dollar Legal & Tax Mistakes...

Here’s something most entrepreneurs and investors never stop to consider…

In business, mistakes are often invisible:

Make a bad investment? The losses are private.

Run the wrong marketing campaign? The data disappears.

Bet on the wrong technology? Nobody writes it down for others to study.

Branding misfires? They fade into obscurity.

But the law is different:

Every mistake is documented.

Every misstep is recorded.

Every consequence is public.

That means, unlike in business or investing, where you’re flying blind

...in law you have the entire playbook of the other side.

You can see exactly how mistakes were made, how they were punished, and how they could have been avoided.

Now, here’s the eye-opener:

The largest tax bill you’ll ever face and the biggest legal battles your family may endure… will likely happen after your death.

But unlike in business or investing, you don’t have to guess or hope.

You have the rules of the game in front of you.

The mistakes have already been made - and recorded- for you.

The choice is simple:

Will you prepare, plan, and bypass those traps?

Or will you leave behind the same 6, 7, or 8-figure mistakes that you already know are waiting?

Debunk The Myth™:

In Pursuit Of The Truth, Beyond The Hype

No blogs found

© Copyrighted Material. All Rights Reserved. Become A Philanthropist LLC.

No Legal, Tax, Financial, or Investment Advice Contained - 100% Educational And Entertainment Purposes Only. No Attorney-Client or Fiduciary Relationship Is Formed By Contacting, Communicating, or Engaging With Us In Any Matter, Unless A Signed Agree Exists With The Terms and Conditions Of The Engagement.