Welcome To The Mini Family Office™

We Help Families Connect "Dots" Between Business, Legal, Tax, and Financial Concepts

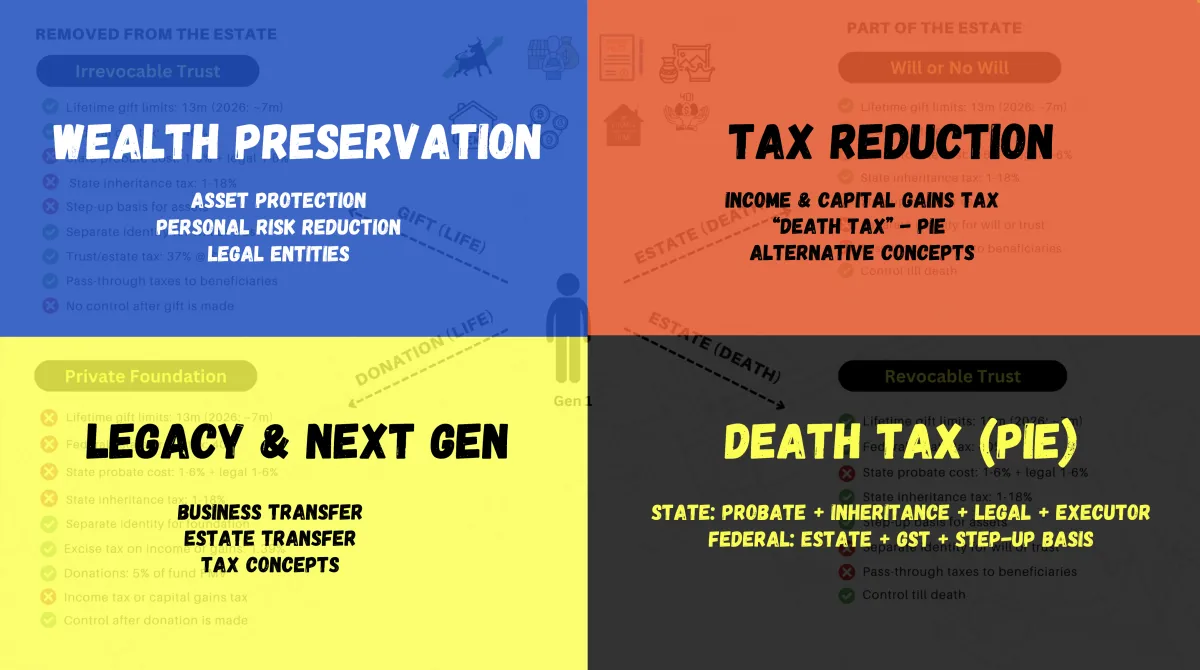

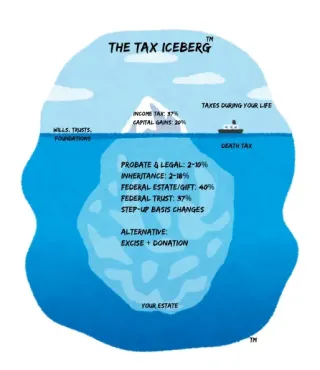

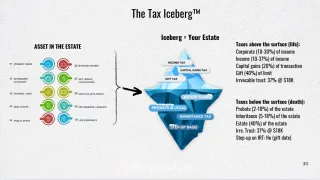

...While Identifying And Fixing The Gaps That Can Dilute 10-50% Your Wealth In The Form Of Legal Fees, Probate Costs, And Taxes.

Two Decades Of Helping Entrepreneurs, Investors & HNW Families Navigate Law & Tax Systems

$5 Billion

In wealth restructured

25,000

Legal and entity filings

$100 Million

In assets dedicated to charity

10,000

Over 10,000 cases under our belt

death and taxes are not optional...

But "Death Tax" Is - If You Play The Right Cards.

Most people build their team of professionals one by one - hiring lawyers, accountants, financial advisors, insurance agents, realtors, investment coaches, and bankers over the years as needs arise.

Each expert brings their own “specialty” and solves a piece of the puzzle - legal, tax, financial, or otherwise. But rarely do these professionals speak to each other, align their advice, or design a strategy as a unified whole.

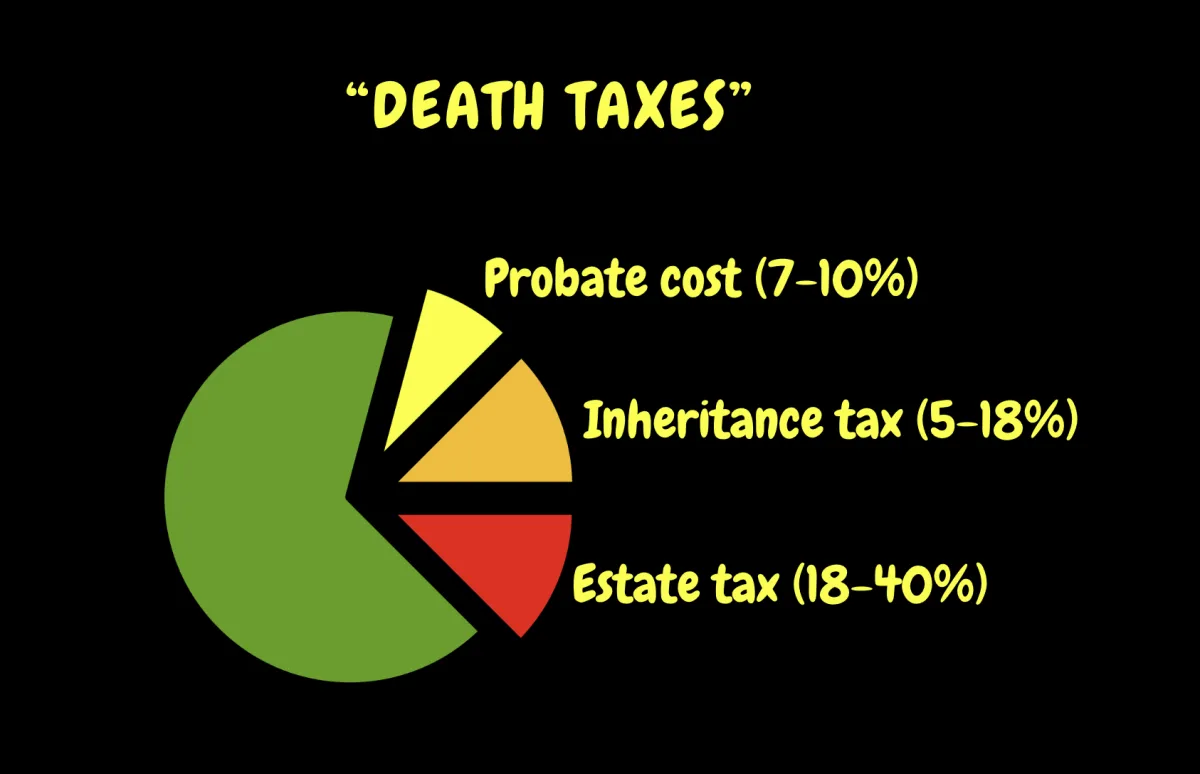

That’s where costly gaps form. Gaps that no one takes responsibility for. Gaps that can silently lead to massive erosion at the worst possible time - in the form of probate fees, legal battles, executor costs, state inheritance tax, federal estate and gift taxes, and generation-skipping penalties.

At Mini Family Office™, our mission is simple:

We help you - and your advisors - spot the cracks before they become 6,7, or 8-figure catastrophes.

Then we design a coordinated, multi-expert strategy to protect your assets, your peace of mind, and your legacy.

Millions of Americans are unknowingly leaving 10-50% of their total wealth to a silent beneficiary: The Government.

Are you one of them?

Hello - Sidhartha here. Philosopher, AI Innovator, Tax Attorney, and Truth Seeker.

I learned the lesson that, "ignorance of the law is not bliss", in 2005, when the banks financing my bakery pulled the plug and forced me into the ground - I was 22 years old and had just graduated with an undergraduate degree in Economics.

Despite having the top experts on my team - lawyers, accountants, financial advisors, stock brokers, bankers, and realtors - the banks and creditors pierced my legal entities, seized my business and personal assets, and forced me into a multi-million dollar bankruptcy.

There were too many inconsistencies, gaps, holes, and leaks in my "core foundation" that were overlooked because my advisors were too focused on their piece of the puzzle - no one helped me "visualize and solve" the big picture and that's where everything fell apart in court.

Since then, I've been on a quest to "discover and fix" the hidden gaps, holes, leaks, and traps between "law, tax, and financial" concepts that can destroy years, if not decades, of hard work and wealth in the snap of a finger.

I studied business and tax law in Canada, the UK, and in the US, and have served over 10,000 people from all walks of life in various business, legal, and consulting roles since 2005. My team and I have filed over 25,000 legal filings in the US & Canada and have restructured well over $5 billion in assets and intellectual property.

While completing law school, my grandfather passed away and left my family with a probate bomb - one that ended up diluting 50% of his wealth and also causing bitter family drama that lasted for several years. That experience sharpened my focus and put me on a quest that is stronger than ever.

Unfortunately, millions of Americans still end up in these situations every single year (see statistics below).

That’s why I do this work.

To help you see what I couldn’t.

To expose the gaps and traps before they become disasters.

To protect what you’ve earned, built, and dream of passing on to your heirs.

We're not looking to replace your advisors and experts, but to help them get aligned, coordinated, structured, and ensure they are operating from the same playbook and working as one "team" - your team.

Because the myth isn’t in the paperwork or the legal structure.

It’s in believing the legal entity and paperwork alone will save you.

At the Mini Family Office™, we help you learn the law, identify and spot these missed gaps, find a set of solutions and alternatives to ensure you have "options" and you can flow like water - around legal gaps, tax scams, financial schemes, and the control traps that can destroy your wealth and legacy.

We invite you to view the case studies, the tax codes, the videos, the podcast series, and the content that we have put together to help you understand and master this area of law. We've complied and compressed decades of research into simple videos, blogs, and articles, and have also included a series of AI prompts that you can use to learn the law with the help of AI.

We look forward to working with you and helping you protect what you're working so hard to accumulate and build.

~ Sidhartha, Esq.

Philosopher. Tax Lawyer. AI Innovator. Legal Mythbuster.™

Here are a few statistics around probate...

~3.1 million people died in the U.S. in 2023. Source: CDC Provisional Mortality Data, 2023

An estimated 60–80% of estates go through some form of probate. Source: Nolo.com – “Avoiding Probate”

Probate costs typically range from 3% to 7% of the estate’s fair market value (FMV), and can exceed 10% in complex cases. Source: AARP & Investopedia

Probate can require 500 to 600+ hours of administrative work, especially in medium-to-large estates. Source: Nolo.com – Executor Duties

In high-volume states (California, Texas, Florida, New York), probate judges often handle over 3,000 cases per year, particularly in urban counties. Source: Texas Office of Court Administration & CA Judicial Council Reports

Why connect the dots and look at the "big picture"?

One wrong move can wipe out 10-50% of your wealth!

Here are some examples of how silly legal mistakes, assumptions, and myths have destroyed wealth...

📜 Revocable Living Trust

Myth: “A revocable trust protects me from lawsuits and estate taxes.”

Gap: Revocable = full control. That means no asset protection and full estate inclusion.

Case: U.S. v. Estate of German, 7 Cl. Ct. 641

Code: IRC §2036 & §2038: retained control = estate inclusion + no creditor shield.

✍️ Wills

Myth: “If I have a will, I avoid probate.”

Gap: A will still directs assets through probate unless replaced by non-probate tools (e.g. trusts, TODs).

Case: In re Estate of Fick, 678 S.E.2d 46

Law: Uniform Probate Code §2-101: wills go through court unless bypassed with planning.

⚰️ Estate Tax Inclusion

Myth: “I gave my assets away - they’re out of my estate.”

Gap: If you retain control or benefit, the IRS pulls it back into your estate.

Case: Estate of Strangi v. Commissioner, 417 F.3d 468

Code: IRC §§2036–2042: control = inclusion, even with advanced structures.

🧾 Gift Tax Confusion

Myth: “I don’t need to file anything if I stay under the annual limit $19,000.”

Gap: Many gifts (especially into trusts) aren’t “complete” - and require Form 709, even if under the annual exclusion.

Case: Estate of Sanford v. Comm’r, 308 U.S. 39

Code: IRC §2503(b), §2511: gifting rules are strict; mistakes = inclusion or penalties.

🛡️ Trusts & Asset Protection

Myth: “All trusts shield me from creditors and lawsuits.”

Gap: Revocable trusts offer zero protection. And offshore trusts don’t work if you keep control.

Case: FTC v. Affordable Media (Anderson case), 179 F.3d 1228

Law: Domestic revocable trusts = fully exposed. Offshore “firewalls” collapse when control is retained.

❤️ No Estate Plan = No Problem

Myth: “My spouse will get everything automatically.”

Gap: Without a full estate plan, assets may default to intestacy laws — leading to probate delays, taxes, or conflicts with children or co-owners.

Case: Estate of Mellinger, T.C. Memo 1999-300

Law: Uniform Probate Code §2-102: spouse’s share depends on heirs, title, and state law.

🏢 Business Succession Is Not An Issue

Myth: “My business automatically transfers to my family when I die.”

Case: Connelly v. U.S. (2023, 8th Cir.): IRS included life insurance in buy-sell agreement as part of estate; triggered valuation and tax issues.

Code: IRC §2031 & §6166: business interests are included in estate, may be subject to estate tax, probate, and valuation disputes.

Gap: No buy-sell agreement, unclear ownership, or co-owner conflict = probate freeze + estate tax on paper value, not actual liquidity.

🧾 Life Insurance Policies Are Tax-Free

Myth: “If my life insurance is in a trust, it’s completely out of my estate.”

Case: Estate of Gerson v. Commissioner, T.C. Memo 1987-567: retained control (changing beneficiaries, paying premiums) brought policy back into estate.

Code: IRC §2042: any incident of ownership = full inclusion of death benefit in taxable estate.

Gap: DIY ILITs often fail when Form 709 isn’t filed, or the grantor retains control or pays premiums directly (instead of gifting).

🪙 Cryptocurrency Is Not Taxed And Is Private

Myth: “Crypto is anonymous and can’t be taxed or traced.”

Case: IRS v. Coinbase (2017): court compelled Coinbase to turn over user data to the IRS.

Code: IRS Notice 2014-21 + IRC §6038D: crypto is property, subject to capital gains, and must be reported.

Gap: Crypto is included in probate, estate tax, inheritance tax, and is traceable with blockchain tools. If keys are lost, assets are unrecoverable - and still taxable.

Learn the law, avoid mistakes, and flow around probate & taxes.

Our Solution: Mini Family Office Model

We Are Legal & Tax Architects That Help You Flow Around The Probate Traps And Gaps That Gets Millions Of Americans Every Single Year.

Here is a fairly comprehensive list of services that we offer in various depths, from basic integrations to detailed execution and implementation of the entire suite of services, generally in conjunction with other experts...

Full legal entity structuring: LLCs, trusts, LPs, foundations

Estate and trust planning (revocable, irrevocable, dynasty, ILITs)

Income, estate, and gift tax planning (IRC §§2001, 2036, 2042, etc.)

Charitable planning (private foundations, CRTs, DAFs)

Public nonprofit integrations (education, research, or charitable foundations)

Intergenerational wealth transfer strategies

Investment oversight (with external managers or in-house team)

Business succession planning

Asset protection (domestic/offshore)

Real estate and luxury asset planning

Insurance audits and structuring

Family governance and education programs

Consolidated reporting across entities

Coordination across all advisors (legal, tax, finance, insurance, real estate)

Lifestyle architecture: advisory services around travel, boat, jets, etc.

AI and tech integration for compliance, risk, and family management

Flow like water, around legal, tax, and probate problems and traps. Let's get started...

Debunk The Myth™:

In Pursuit Of The Truth, Beneath The Hype

Myth or Fact: My IP Is registered - I'm set!

In this blog, we'll examine some popular claims and marketing pitches made in the world of IP law ...more

Strategic Philanthropy

July 07, 2025•0 min read

Myth About Land Trusts & Taxes

Learn how land trust and real estate trusts really operate, beyond the hype, beyond the sales pitches, and learn how the IRS looks at them ...more

Strategic Philanthropy

July 04, 2025•0 min read

Estate Planning Myth: One Size Fits All Programs And Templated Estate Plans

avoid probate and minimize taxes by understanding how to use all the entities at your disposal ...more

Strategic Philanthropy

June 29, 2025•6 min read

Debunking the Myth: My Professionals Handle That or Know What to Do—Reality: They Don’t Know What They Don’t Know

debunking the myth that your professional is going to handle the gaps in your legal, tax, and finance stratgies ...more

Strategic Philanthropy

June 29, 2025•9 min read

Gift & Estate Tax Myths: Debunked

Explore the various myths around estate and gift taxes and how they work. ...more

Strategic Philanthropy

June 29, 2025•9 min read

Debunking the Myth: The Revocable Trust Illusion—Why It Fails to Protect Wealth for High-Net-Worth Individuals

how does a revocable trust work ...more

Strategic Philanthropy

June 28, 2025•6 min read

© Copyrighted Material. All Rights Reserved. Become A Philanthropist LLC.

No Legal, Tax, Financial, or Investment Advice Contained - 100% Educational And Entertainment Purposes Only. No Attorney-Client or Fiduciary Relationship Is Formed By Contacting, Communicating, or Engaging With Us In Any Matter, Unless A Signed Agree Exists With The Terms and Conditions Of The Engagement.